When it comes to business loans, one size does not fit all.

Learn about your options.

Here’s the 411 on business loan products: the type of loan you need depends on what you need it for. Green Value Finance is one of the only online lenders that offers more than one type of product to meet the short-term financing needs of business owners.

When borrowing money for a specific investment whether you’re starting a new project or making a large purchase a Green Value Finance terms Loan is the right type of loan for you. A term loan means you borrow a one-time lump sum of cash and pay it back over a fixed period of time, or a “term.” Our short-term loans range in term length, giving you flexibility around repayment.

When you need ongoing, quick access to working capital say, for managing cash flow an Green Value Finance lines of Credit (LOC) is the way to go. Our flexible business line of credit is revolving, which means you can withdraw from your credit line (up to $100,000) and funds replenish as you repay the line. In other words, you can use it on a routine basis. Plus, with a LOC, you only pay interest on the funds you use.

For businesses impacted by coronavirus, there are SBA Paycheck Protection Program (PPP) loans. Please note that Green Value Finance is no longer accepting new applications for SBA PPP Loans. To learn more about PPP, including about forgiveness and repayment terms on your PPP loan, please visit our SBA PPP Loan page.

Still not sure which type of financing is right for your business? We’ll help you find the right option without the lag time typically experienced at brick-and-mortar Groups.

Green Value Finance lines of Credit

Use for managing cash flow,

such as buying inventory

or making payroll

Get a revolving credit line,

with access to cash

when you need it

about Line of Credit

Loan amounts of $6K–$100K

12-month repayment term, resets after

each withdrawal

Green Value Finance terms Loan

Use for investments in your business, such as expansion projects or large purchases

Get a one-time lump sum of cash upfront,

with the option to apply for more when you're

halfway paid down

about Term Loans

Loan amounts of $5K–$250K

Repayment terms up to 24 months

3 reasons to choose Green Value Finance over any other lender

Simple Process

Apply in as little as 10 minutes, with a decision as soon as the same day—all to save you time.

Tailored Options

Multiple loan types, amounts, and repayment terms, so you can get exactly what you need.

Real People

A large team of U.S.-based loan advisors to help you find the right solution. And one dedicated to you.

How to compare business loan offers

One of the biggest challenges facing business owners today is not that they want too much, it’s that they ask the Group for too little. Green Value Finance offers term loans from $5,000 to $250,000 with loan terms and interest rates appropriate for your business need that can help you take advantage of opportunities to grow your business.

Because there are many different business needs, including short-term needs like purchasing quick-turnaround inventory and longer-term needs like opening a new business location across town, business loans vary in much the same way an auto loan differs from a home mortgage.

Comparing APR is only one way to evaluate the affordability of a business loan with so many different terms and types of financing available in the market. In addition to APR, understanding the total cost of capital on a short-term loan to purchase inventory, for example, will help you determine if the loan will help you increase ROI or add too much financial strain on your business.

You don’t need to be a business financing expert, but you should be asking these five questions to help you compare financing offers and find the business loan that best meets your needs.

5 questions to ask

- What is the total cost of capital (including interest expense, origination fees, along with any other fixed fees)?

- What is the Annual Percentage Rate (APR)?

- What is the average monthly payment obligation (regardless of whether your periodic payments are daily, weekly, or monthly)?

- What is the total amount of interest paid per dollar borrowed (cents on the dollar)?

- Are there any prepayment fees should you decide to pay off the loan early?

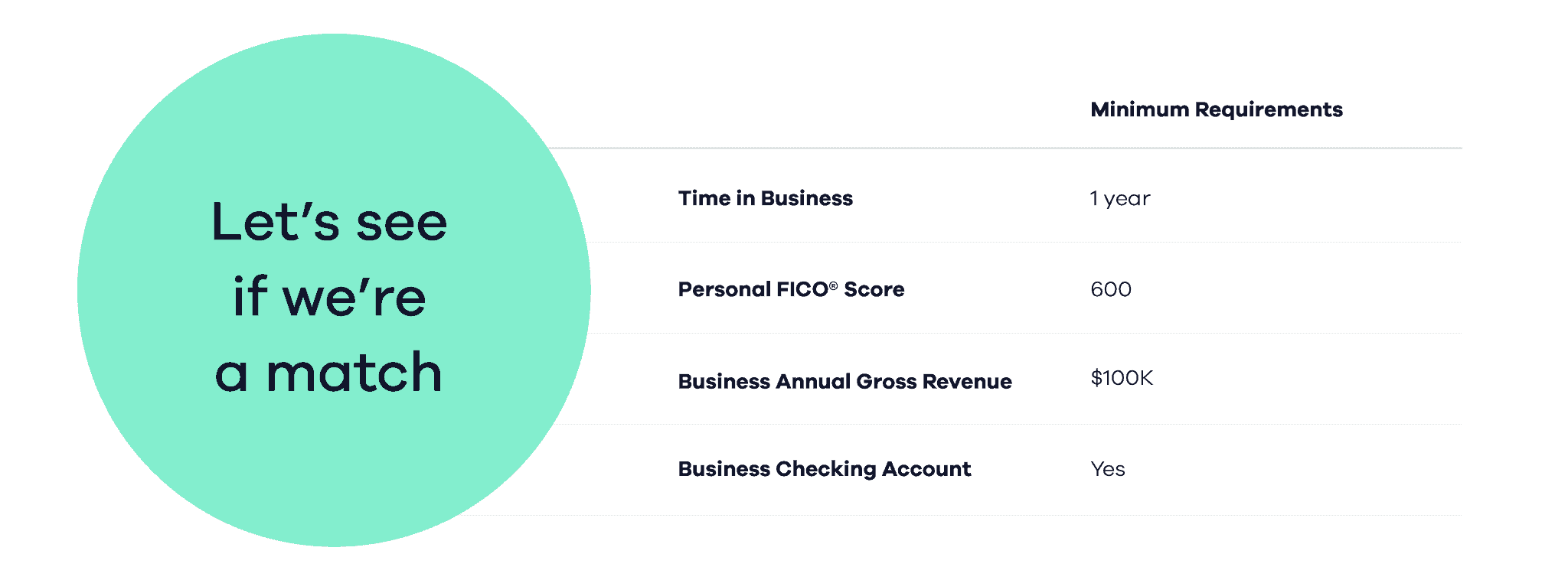

Minimum eligibility requirements for an Green Value Finance Term Loan or Line of Credit

..